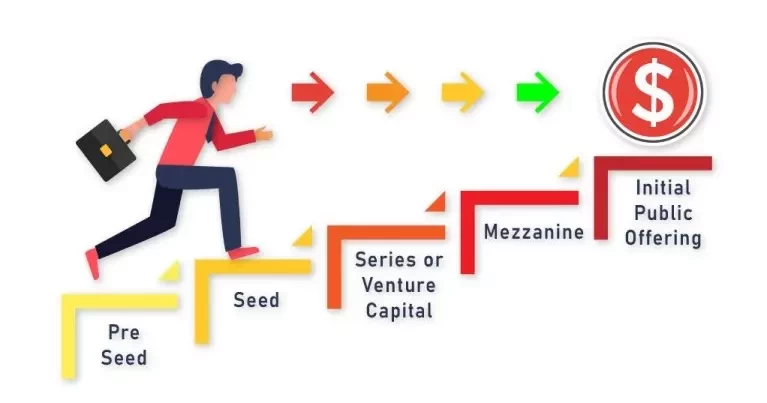

The Startup Stages

The funding stages

Finally, here’s where all the seeds we’ve sown in the past paragraphs come into fruition.

Under this heading, we’ll explore the funding stages that the investors we’ve listed above participate in.

Pre-seed

As the name implies, the pre-seed stage consists of a startup’s first push to raise funds to get its operations running. In this stage, you won’t see many VCs or PEs because the startup is at its earliest stages and the only people willing to take a chance on it are angel investors.

The sizes of seed stages can vary, depending on the startup. For example, Herconomy’s pre-seed was $600,000 while Nestcoin, a blockchain startup out of Nigeria, raised $6.5 million in its pre-seed round.

Conventionally, VCs don’t participate in pre-seed rounds but that’s slowly changing on the continent as more early-stage startups bring innovative solutions to the continent’s most pressing issues.

Seed

Seed stages come after the pre-seed stages, and they’re usually when the startup has built enough traction to attract institutional investors like VCs or PE firms.

As in the pre-seed stage, there’s necessarily no maximum or minimum amount for what qualifies as a seed. It all depends on the startup.

In 2019, however, Palmplay raised the largest seed funding Africa has seen so far with $40 million.

3. Series A B C D E F to infinity…

Here’s what you need to keep in mind about Series A, B, C… funding stages: the letter of the alphabet attached to a funding round expresses the number of times that a startup has raised external funding. Essentially, the naming helps differentiate each new funding round from the previous ones.

In Series A and B funding, startups have entered their target market but need financing to build relationships with customers and further develop their business models.

Every round after a Series A is not so different in terms of deal structure. Most startups at these stages are looking to expand into new markets, launch new products or release new features. From Series C upwards, startups are looking to maximise profitability and growth, expand into new markets and push out new products. Of the 8 African unicorns—startups valued over $1 billion—6 attained unicorn status during or after their Series C rounds.

It is, however, important to note that most African startups don’t make it past the Series B funding stage. The World Economic Forum states that only 8% of startups on the continent make it past Series B and this is due to a number of reasons including lack of funding and operational failure.

The good news, however, is that more startups are popping up and solving problems acoss board. The number of African startups that have been able to secure funding has increased from 55 startups in 2015 to 359 startups, a 552.73% growth. What this means is an increased chance of solving African problems.

Credit: TechCabal

Arabic

Arabic French

French Chinese

Chinese